Beta values: Risk Calculation for Axfood and Volvo Bottom up beta approach vs. CAPM beta: Ljungström, Divesh: 9783838309743: Amazon.com: Books

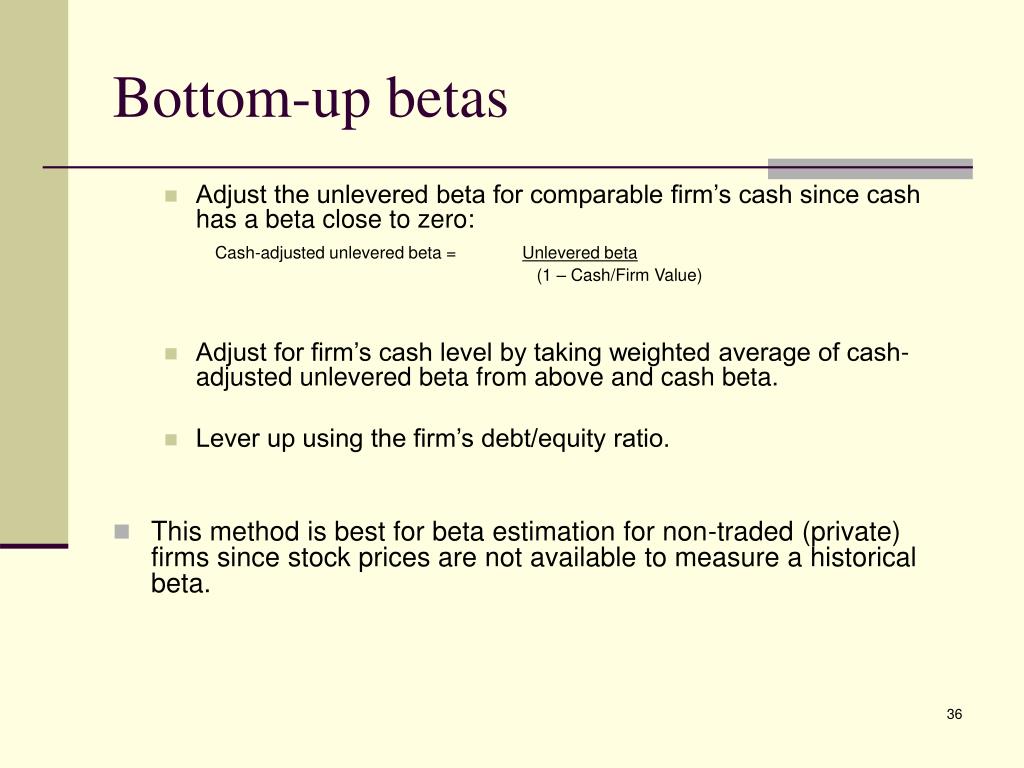

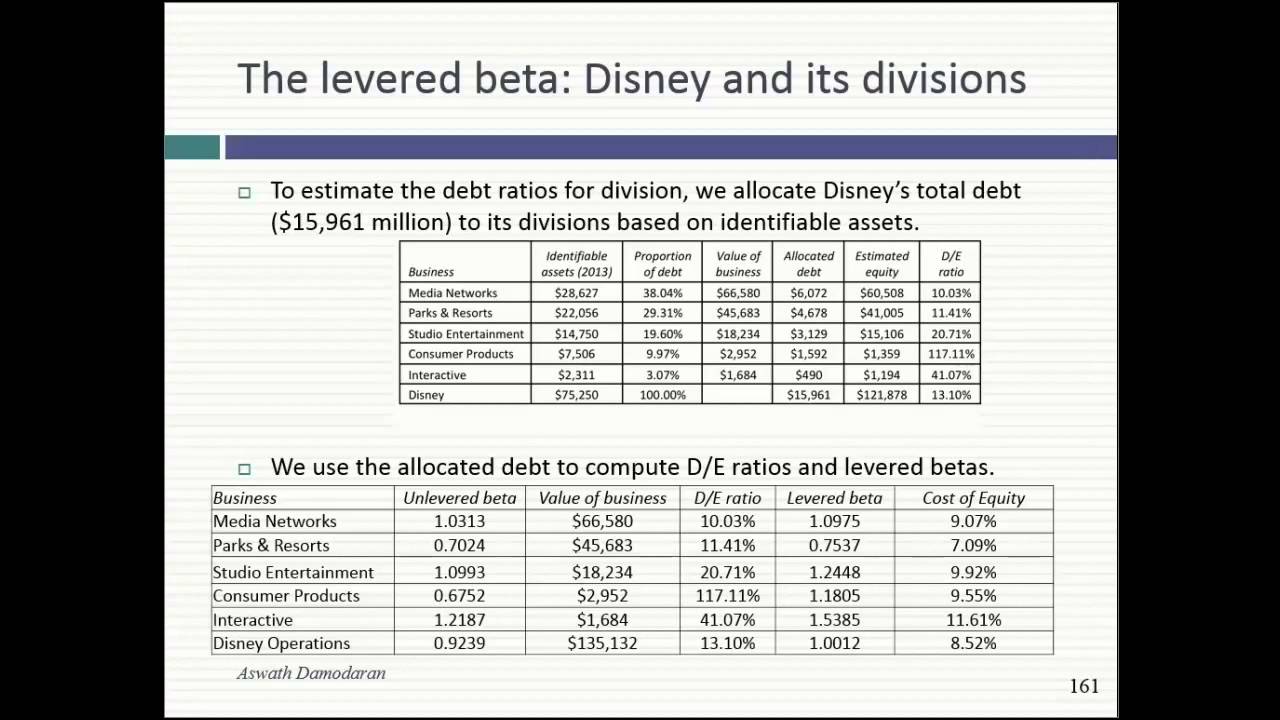

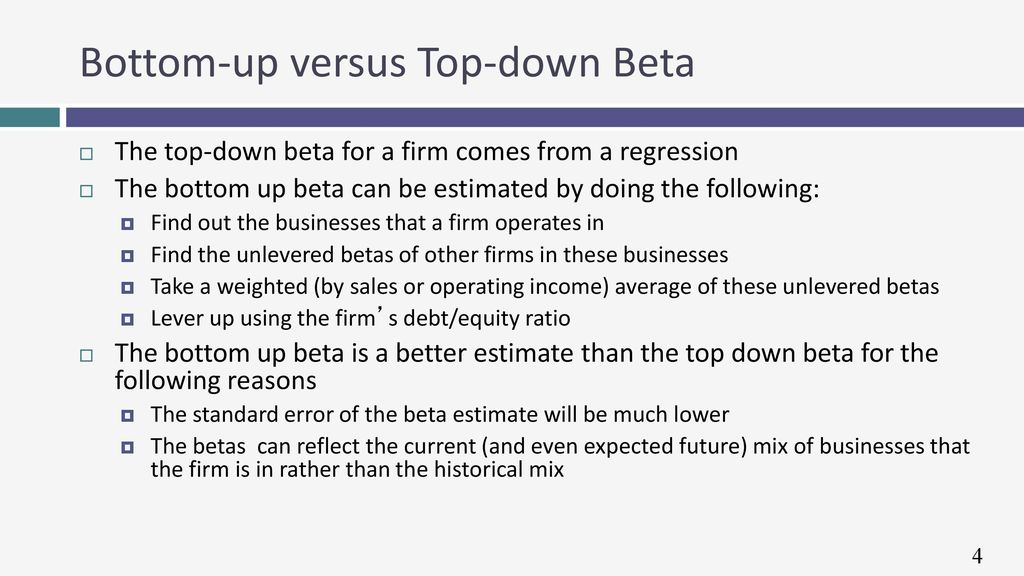

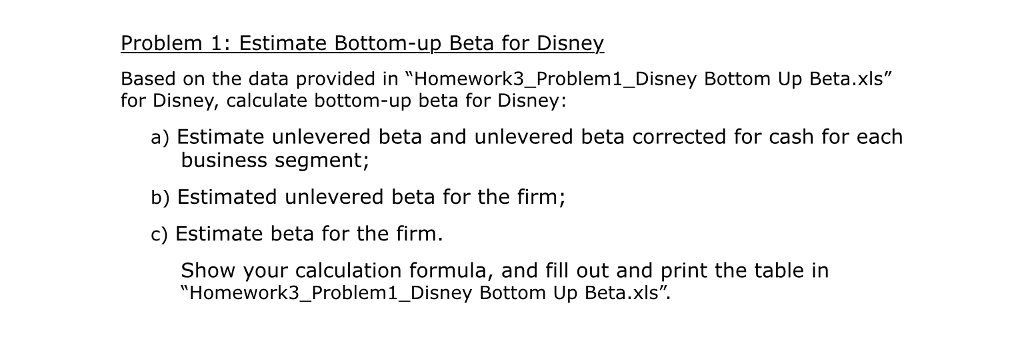

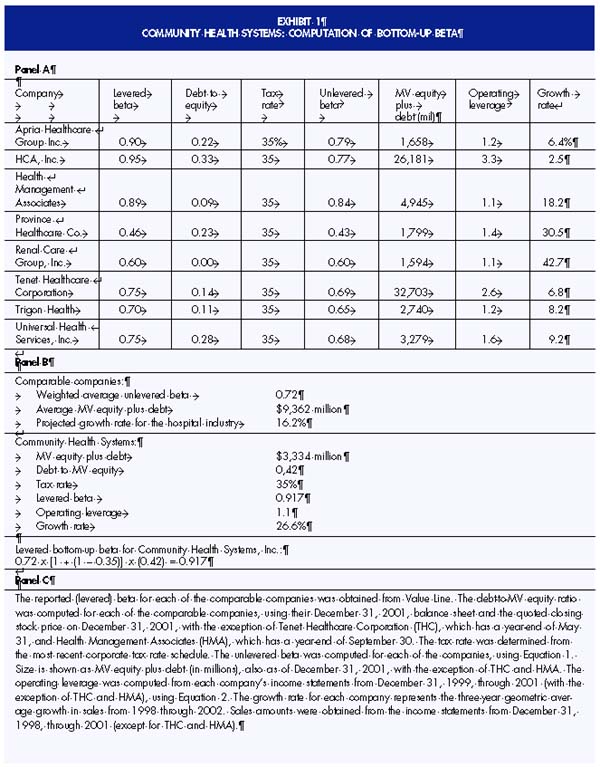

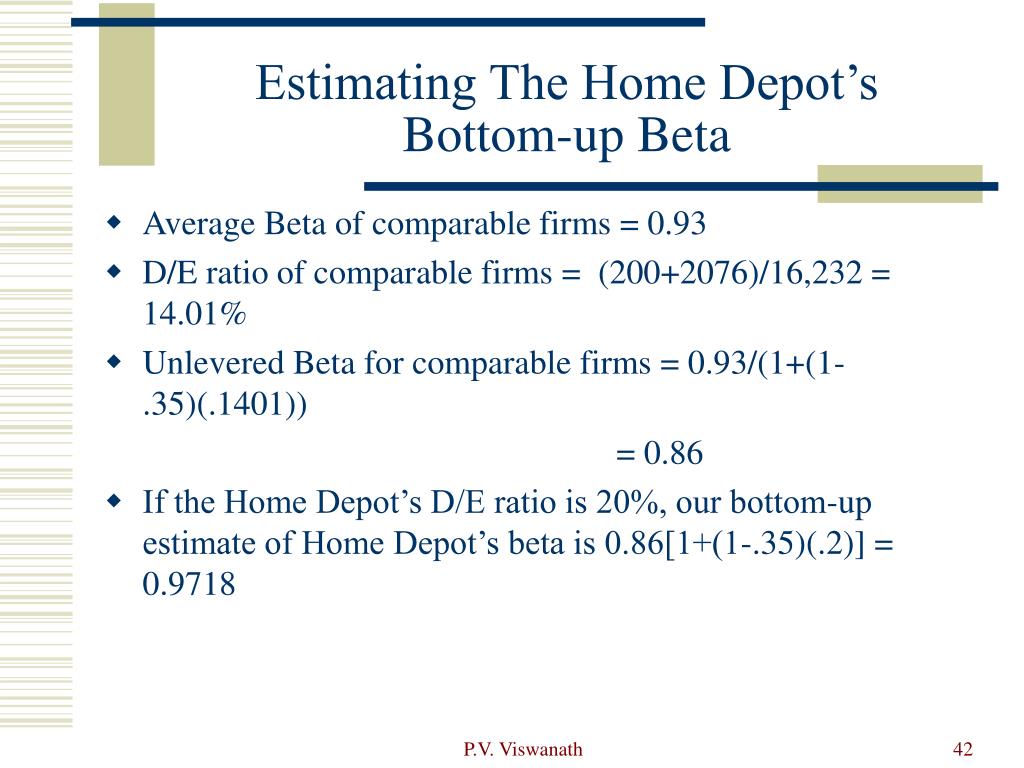

Beta. The standard procedure for estimating betas is to regress stock returns (R j ) against market returns (R m ): R j = a + b R m where a